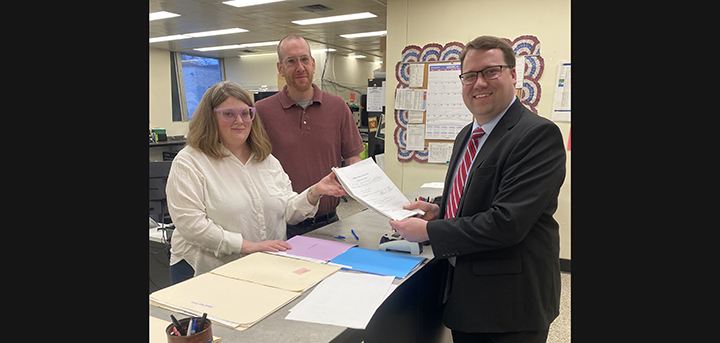

Schumer Calls On IRS To Grant NY'ers Ability To Deduct 2018 Property Taxes

Published:

January 19th, 2018

NEW YORK STATE – On Tuesday, U.S. Senator Charles E. Schumer called on the Internal Revenue Service (IRS) to immediately grant New York residents, who paid their 2018 property taxes early, the ability to apply those taxes to their 2017 state and local tax deductions, even if their property taxes were not assessed. Schumer, the Senate Minority Leader said, this would allow these taxpayers to take a larger state and local deduction in 2017, before the harmful, new state and local tax deduction (SALT) cap takes effect.

“The just-passed tax bill hammers middle-class New Yorkers and any relief that can be provided – by the IRS or any other entity – must be provided,” said Senator Schumer. “That is why I am calling on the IRS to let New Yorkers who prepaid prior to January 1, 2018 to deduct their property taxes in tax year 2017. The IRS should follow the letter of the law and allow these prepayments to be counted in tax year 2017.”

The Evening Sun

Continue reading your article with a Premium Evesun Membership

View Membership Options

Comments